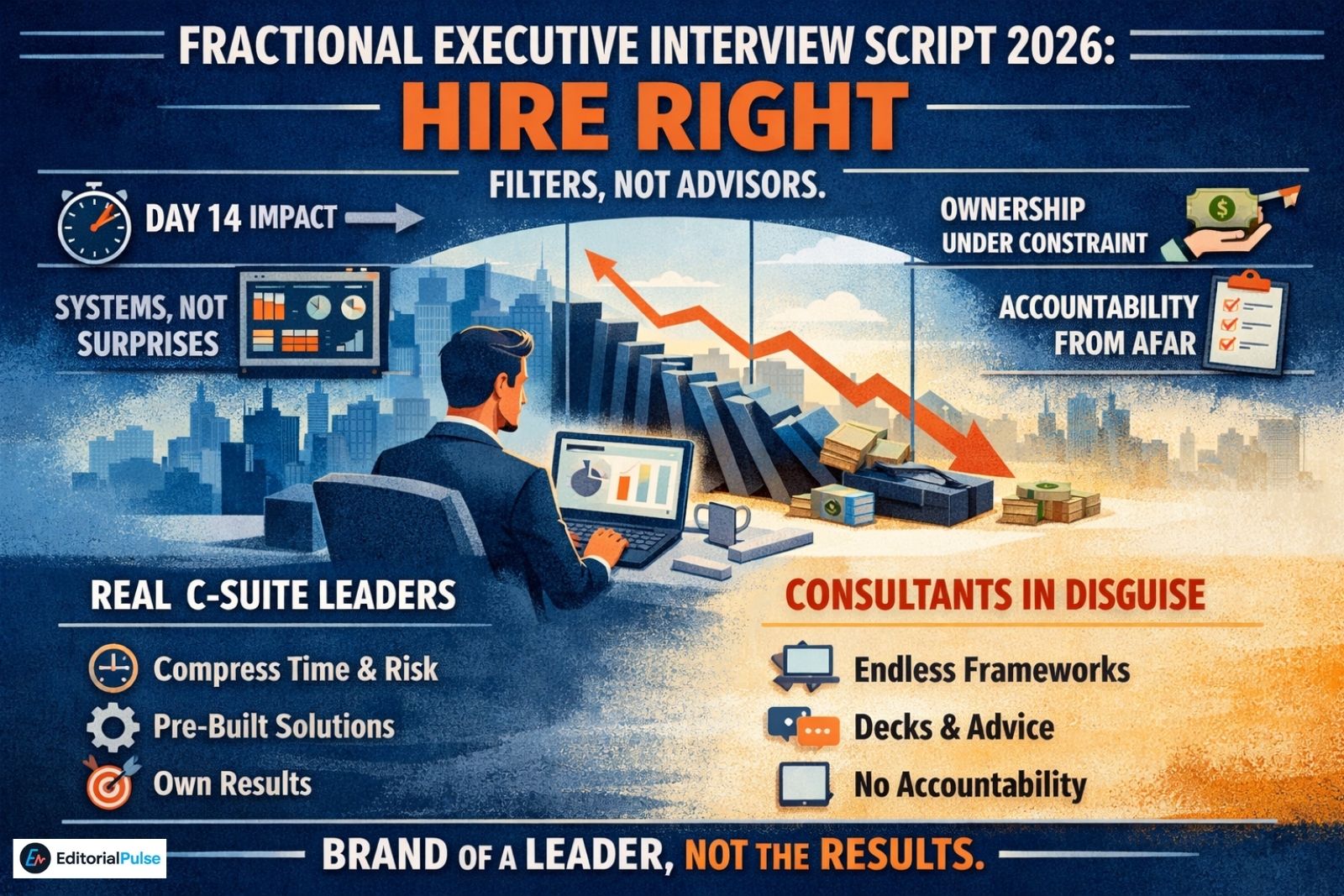

By 2026, hiring a fractional executive is no longer experimental; it has evolved into a core operating model for agile organizations. For founders, it is now a critical capital‑allocation and governance decision.

Founders aren’t bringing in part‑time CFOs, CMOs, or COOs to “advise.” They’re doing it to avoid expensive mistakes, compress decision cycles, and borrow the pattern recognition of people who’ve already scaled — and broken — companies before.

The problem is supply. The fractional market is crowded. For every true fractional leader who owns outcomes, several consultants are using the title because it converts better.

This is a ready‑to‑use fractional executive interview script, written for founders in 2026. These are not generic behavioral questions. They are filters — designed to reveal whether a candidate thinks and operates like a real C‑suite leader or an advisor in disguise.

Why Interviewing Fractional Leaders Is Different

Interviewing a fractional executive is not the same as hiring full‑time leadership.

You are not testing:

- Long‑term cultural fit

- Career trajectory

- Team management at scale

You are testing:

- Judgment under constraint

- Ownership without proximity

- Speed to leverage

A real fractional leader does not need months to ramp. They are paid for compression — of time, risk, and ambiguity.

The Fractional Executive Interview Script (2026)

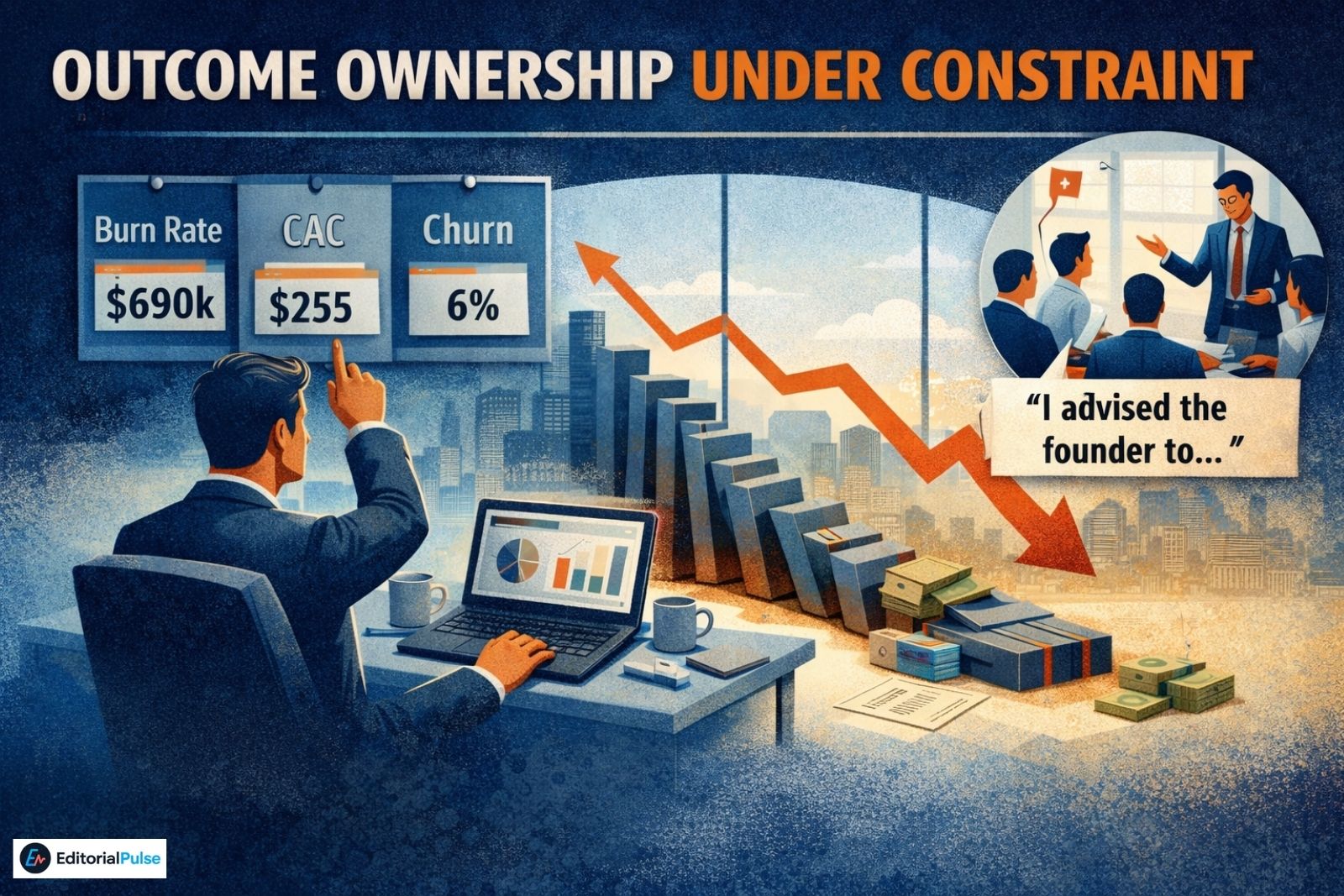

1. Outcome Ownership Under Constraint

Ask:

“Tell me about a decision you owned as a fractional executive that materially affected the business. What was the outcome?”

Listen for:

- Clear decision authority (not influence)

- Numbers tied to the decision (burn, CAC, churn, revenue)

- Accountability for results — including mistakes

Red flag language:

“I advised the founder to…”

That’s consultant framing.

2. Speed to Leverage (The First 14 Days)

Ask:

“You’re working with us 1–2 days a week. By Day 14, what should be undeniably clearer or better?”

Strong answers reference:

- One or two leverage points, not a roadmap

- Pattern recognition (“I’ve seen this exact issue before”)

- Decision bottlenecks, not task lists

Founder reality check: By Day 14, a real fractional leader should have identified your silent killer — the constraint you’ve normalized because you’re too close to the business.

If they’re still onboarding in week three, you hired an advisor, not an operator.

3. Systems Over Opinions (The Stack‑in‑a‑Box Test)

Ask:

“What systems or tools do you typically bring with you on day one?”

In 2026, elite fractional leaders arrive with a stack‑in‑a‑box.

You want to hear about:

- Pre‑configured dashboards

- Automated reporting

- Forecasting, revenue, or ops systems that work without daily presence

Consultants give opinions. Fractional executives leave systems that continue delivering after they step back.

4. Accountability Without Presence

Ask:

“How do you stay accountable when you’re not in the business every day?”

Strong answers include:

- Weekly metrics cadence

- Async decision logs

- Explicit decision rights

Red flag:

“It depends how involved the founder wants me to be.”

That’s abdication, not leadership.

5. Scar Tissue (Experience Filter)

Ask:

“What’s a mistake you’ve seen founders make by hiring fractional leadership too late — or the wrong way?”

People who’ve lived it answer differently.

A strong response sounds like:

“I saw a Series A company wait until diligence to bring in a fractional CFO. Untracked liabilities nearly killed the round.”

No scars usually means no real ownership.

The Vested‑Interest Test (2026 Signal)

A hard truth founders learn late:

A true fractional executive often asks about alignment, not just scope.

In 2026, strong candidates frequently raise:

- Performance bonuses

- Outcome‑based retainers

- Limited performance equity tied to a North Star metric (NRR, EBITDA, CAC payback)

If a candidate refuses any form of shared upside or downside, they’re likely optimizing for retainer stability — not results.

Consultant‑in‑Disguise Warning Signs

Be cautious if the candidate:

- Avoids owning numbers

- Over‑indexes on frameworks

- Talks more about decks than decisions

- Can’t articulate trade‑offs

One uncomfortable truth:

The wrong fractional executive creates the illusion of leadership without accountability.

Contractual Nuance Founders Miss

Always include a knowledge‑transfer clause.

If your fractional leader exits, you don’t want:

- Ad accounts no one controls

- Dashboards no one understands

- Processes locked in someone else’s head

A real fractional leader plans for partial obsolescence. Consultants don’t.

Also Read: CPS Reflect and Learn Login Help + REACH Guide (2026)

When Fractional Leadership Is the Wrong Choice

Fractional is not a fit when:

- The role requires daily execution

- Decisions need constant in‑room presence

- Outcomes can’t be measured cleanly

In these cases, you’re not under‑hiring — you’re mis‑hiring.

Simple Scoring Framework (Use This)

Score each answer from 1–5 across four dimensions:

- Outcome ownership

- Decision clarity

- Systems thinking

- Accountability

Strong fractional leaders score consistently high across all four.

FAQs

Q1. What is a fractional executive and why hire one in 2026?

A fractional executive is a part-time C-suite leader who owns outcomes, not just advises. In 2026, startups hire them to reduce costly mistakes, accelerate decision-making, and access senior expertise without a full-time salary. Fractional leaders bring systems, dashboards, and AI-enabled workflows to deliver value quickly.

Q2. How do I interview a fractional executive effectively?

Use a structured interview script focused on outcome ownership, systems thinking, accountability, and experience. Ask about early leverage points (Day 14 milestones), tools or “stack-in-a-box” setups, and past results under constraints. Avoid candidates who speak only in frameworks or advice—they’re likely consultants, not operators.

Q3. What’s the difference between a fractional executive and a consultant?

A consultant gives advice; a fractional executive owns results. Fractional leaders are measured on outcomes like burn rate reduction, revenue acceleration, or operational efficiency. They bring pre-configured systems, AI tools, and structured reporting, whereas consultants often lack accountability or ongoing operational involvement.

Q4. How much do fractional executives cost compared to full-time C-suite hires?

In 2026, elite fractional leaders typically command $5,000–$15,000 per month depending on the role and scope. This is often 30–60% of the cost of a full-time C-suite executive, with the added advantage of faster time-to-value and risk mitigation through outcome-based retainers.

Q5. What are the risks of hiring the wrong fractional executive?

The wrong hire can create the illusion of leadership without accountability, slow decision-making, and leave knowledge gaps. Mitigate this by using structured interviews, scoring frameworks, and including knowledge-transfer clauses in contracts. Ensure candidates are willing to align incentives to your startup’s key metrics.

Final Thoughts

Founders in 2026 aren’t hiring fractional executives to save money.

They’re doing it to avoid expensive mistakes made too late.

If a candidate can’t show you how they think, decide, and deliver without being full‑time, they’re not fractional leadership.

They’re consulting with better branding.

Related: Tavl Web 2026: Full Login, Features & Setup Guide